Indiana 529 Contribution Limit. Review how much you can save for college in these plans. Currently, the credit is equal to 20% of the amount contributed during the year, up to a maximum of $1,000 for single taxpayers and those married filing jointly.

529 Plan Contribution Limits Rise In 2025 YouTube, You can then contribute up to $450,000—one of the.

529 Plan Contribution Limits 2025 Aggy Lonnie, Learn how much you can contribute to a 529 plan in 2025.

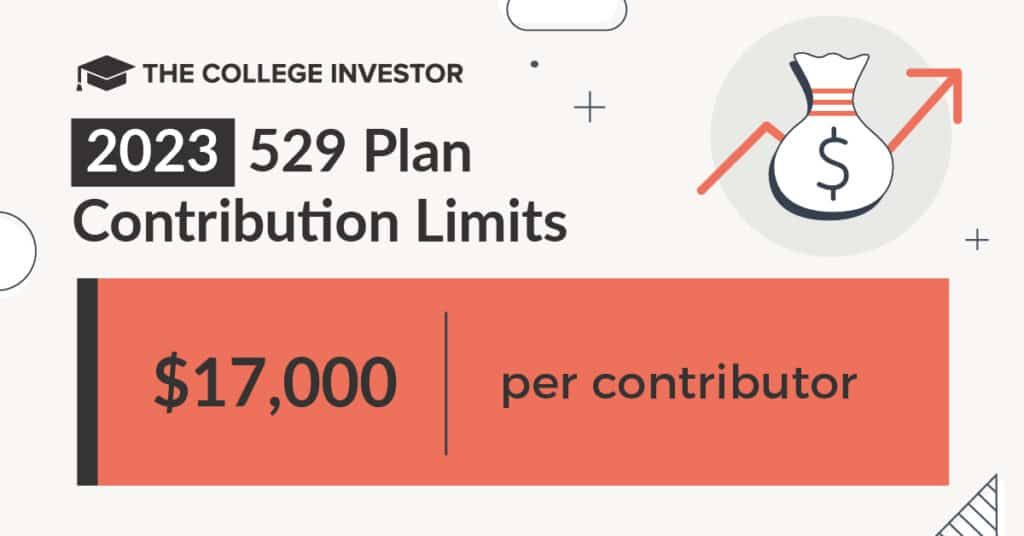

Indiana 529 Contribution Limits 2025 Faythe Cosette, There are no annual 529 contribution limits, but each state has an aggregate limit.

Indiana CollegeChoice 529 Plan Increases Credit Maximum For, 50 OFF, Contribute when you can, or set up a recurring contribution on a monthly, quarterly, or annual basis.

529 Plan Contribution Limits in 2025, Individual states sponsor 529 plans and have varying total account maximums determined by a given state.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, Contributions are treated as completed gifts, and you may apply $18,000 contribution ($36,000 per married couple) for annual gift tax exclusion.

529 Accounts in the States The Heritage Foundation, Indiana offers a 20% tax credit worth up to $1,500 ($750 for married filing separately) for contributions made to an indiana 529 plan, regardless of tax filing status.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

Indiana 529 Plan Update — Aurora Financial Strategies, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.